During the Covid Pandemic, a spike in prepayments was observed in the United States, because customer deposits increased due to the inability of customers to spend money. This effect on prepayments is further compounded by market rates that were at historically low levels, causing an incentive for customers to refinance their mortgage against a lower rate. With the Covid Pandemic behind us, and rising mortgage rates, banks may be inclined to reevaluate their prepayment models.

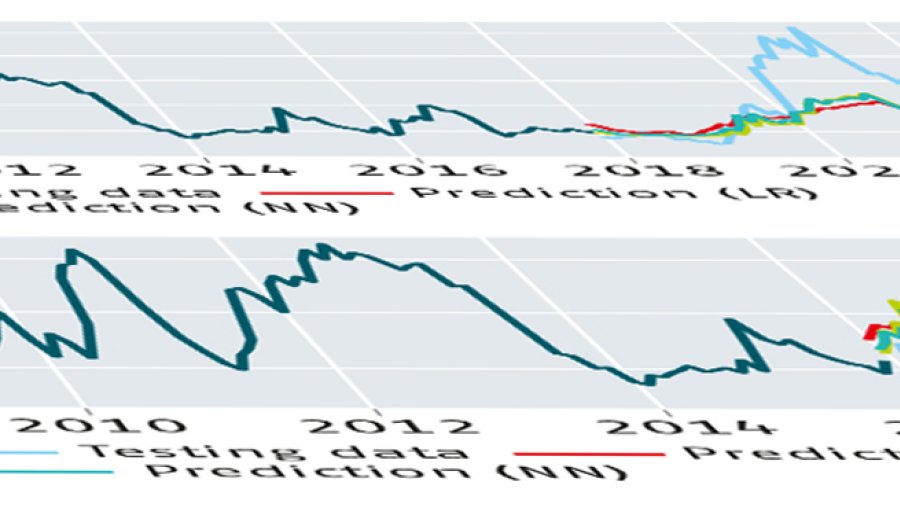

Our research contributes to the aforementioned challenge by investigating different prepayment models, as well as the influence of different calibration periods, on the estimated prepayment amounts. In- or excluding the Covid period in data used to calibrate or test the model can have a significant effect on the model performance. Therefore, investigating this effect on the estimated prepayment amounts is the key focus of our research. By understanding this dynamic, financial institutions can make informed decisions about the optimal calibration strategy for their portfolio.

Lees dit artikel verder onder Download.

Download

- Unmasking Covid's Impact on Multiple Prepayment Models .pdf • 0,11 MB