Machine Learning (ML) and Deep Learning (DL) methods have the potential to improve the accuracy and efficiency of Internal Models for calculating, among other metrics, the Solvency Capital Requirement (SCR) for insurance companies. These methods can be used to better reflect the complex and often non-linear relationships between different risk factors and to identify patterns and trends in the data that may not be apparent through traditional modeling approaches.

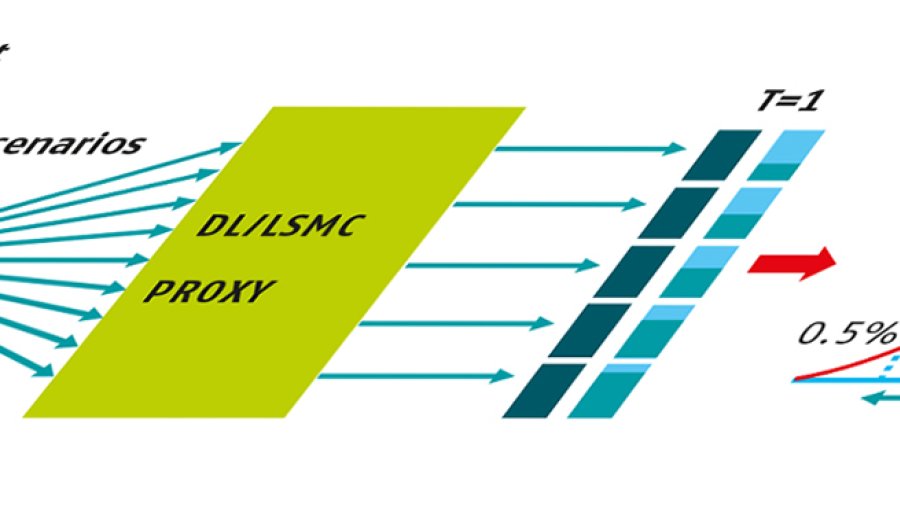

In this research, a DL proxy model is developed that challenges the industry standard proxy model: Least-Squares Monte Carlo (LSMC). The aim is to either outperform the benchmark LSMC proxy in terms of accuracy and/or computational performance of the calculation of Own Funds (OF) and other Solvency II (SII) metrics (SCR, SII Ratio, Operating Capital (OC)). In terms of accuracy of calculating these metrics, together with the computational performance, this DL proxy model shows promising results.

Lees dit artikel verder onder Download.