With the SEC in the US having issued their final requirements for climate-related disclosures on 6March2024, we can compare their requirements with the EU’s Corporate Sustainability Reporting Directive (CSRD) and the International Sustainability Standards Board (ISSB).

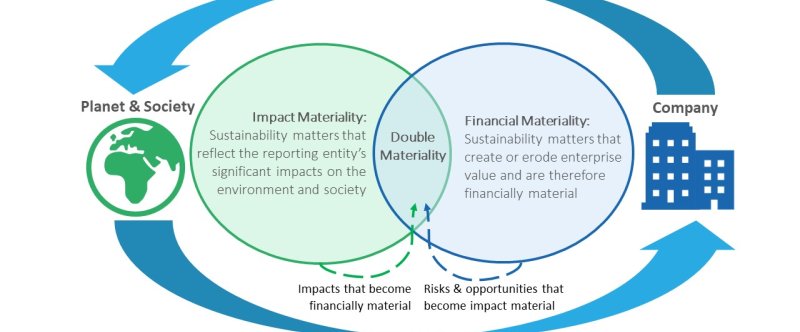

The CSRD standards include specific materiality assessment requirements for both the financial and impact aspects, or “double materiality”. On the other hand the SEC and ISSB require a financial materiality assessment only, often referred to as “single materiality”. The focus on the financial assessment is likely driven by the fact that the riskiness of their returns is the top priority for most investors. However, investors are becoming more concerned with the influence they can have on improving sustainability and ESG issues. The CSRD standard addresses this desire for information with the double materiality disclosure.

Embracing double materiality not only meets reporting requirements, it also demonstrates an insurer’s commitment to sustainable practices.

Double materiality recognizes a company’s inside-out and outside-in impacts. The inside-out perspective considers how the insurer's decisions impact sustainability and ESG issues, and is referred to as the non-financial assessment or impact assessment. This includes assessing climate-related risks, fair treatment of policyholders, promoting diversity and inclusion, and contributing to overall societal well-being.

The outside-in assessment is similar to the typical financial risk assessment that insurers are familiar with, which considers how changes to climate, sustainability and ESG factors will impact the insurer’s profitability and strategy.

To effectively integrate double materiality into reporting frameworks, a systematic approach is required involving several key steps:

- Establishing a foundation: Understand the broader context of sustainability and ESG, and become familiar with reporting obligations.

- Engaging stakeholders: Meaningful dialogue with stakeholders, including investors, customers, employees and communities, provides insights into their expectations.

- Scoping the assessment: Research aspects of the company's operations, products and services, and geographical locations.

- Risk Identification and Analysis: Conduct a thorough risk assessment to identify sustainability risks and opportunities over different time horizons.

- Materiality Matrix Development: Prioritise issues for detailed disclosure through the creation of a materiality matrix based on their impact and importance to stakeholders.

- Data Collection and Metrics: Collect quantitative and qualitative data relevant to the material issues, and define KPIs and metrics that align with the CSRD requirements.

- Reporting and Continuous Improvement: Prepare a sustainability report outlining the company's approach to addressing material issues and plans for improvement.

Embracing double materiality not only meets reporting requirements, it also demonstrates an insurer’s commitment to sustainable practices. This fosters financial resilience, environmental stewardship, and societal well-being, positioning the insurer as a responsible entity, contributing to a sustainable future.

This blog is written in a personal capacity.